(This is a note prepared for the Legislative Council's Inquiry into the Provisions of the University of Tasmania Act 1992)

Introduction

The recent

tabling of UTAS’ 2022 Annual Report is an opportune time to have a close look at

UTAS’ current situation.

Rather than

just a snapshot of one year’s financials, a few past years will provide a

better basis to form a view of how UTAS has arrived at where it is now, and

what this means for the future.

The

following note is based on UTAS’ financial statements since 2015. It is not a

management accounting exercise looking at costs, revenues and student numbers

etc, for that is outside the Committee’s Terms of Reference, rather an

explanation of UTAS’ overall financial situation.

UTAS’ net profits are very volatile.

Stripping away capital grants and

investment income however leaves a more sedate picture.

Unfortunately, all that’s left are

losses, losses from the core activities of teaching and research, and losses

caused by a relentless pattern of what UTAS describes as restructuring costs.

It’s not so much that UTAS’s buildings

may no longer be suitable, but its current financial model is not fit for

purpose.

The gobsmacking reality which UTAS

has kept hidden, is that deficits from core activities have been funded by

investment income, which inevitably will fall as investments are redeemed to

fund the Hobart CDB move.

If as UTAS has suggested, the prize at the end of the day is only $200 million once the Sandy Bay assets are monetised (as consultants term it) and the development costs in the Hobart CDB paid for, how will deficits from UTAS’ core activities be funded?

Over the past eight years the value

of UTAS’ equity (its net assets) has grown by a modest 150 per cent despite receiving

$301 million in capital grants, spending over $1 billion on property plant and

equipment assets and booking a $167 million revaluation of its properties in

the 2022 year.

Yet its liabilities have grown by 350

per cent over the same period.

UTAS still has plenty of assets, but

the increased liabilities need servicing.

As more cash is used to service

liabilities, net operating cash comes under pressure resulting in less cash

available for other needs.

If the Hobart move proceeds, it will

be a voyage into the unknown. Are there sufficient cash buffers for such a

venture? It’s doubtful on the evidence to date.

One inescapable conclusion is that

UTAS’ recent $350 million Green Bond issue, which was thought by many at the

time to be sufficient to fund its move into the Hobart CDB until surplus assets

at Sandy Bay start producing revenue,[1] won’t be nearly enough for that purpose.

Even if UTAS bows to community

pressure and either re-thinks or abandons its Hobart CDB move, more borrowings

are likely as existing cash and readily redeemable investments won’t last long

given the commitments disclosed in the 2022 financial statements.

Any borrowings will require the

Treasurer’s approval. This is where UTAS’ problems become a matter for all Tasmanians.

Any borrowings will require security,

particularly if Tascorp, the government’s finance arm, obliges. Any additional

secured loan puts the $350 million Green Bond holders in a riskier position.

The latter felt safe because they were led to believe their investments would

be enough to fund UTAS’ expansion plans. As an investment become riskier, its

value falls. If UTAS suffers a consequent credit ratings downgrade and Green

Bond investors see a further decline in the value of their investments, Tasmanians

will feel the backwash.

UTAS and the State government are

inextricably linked. To what extent is not quite clear. Vice Chancellor Rufus

Black believes UTAS is ultimately a state entity, implying that the State

government will come to the rescue if needed. Is this the legal or the

pragmatic reality? Large organisation such as UTAS are well versed in the

Doctrine of Moral Hazard. Hence it could well be the latter.

Or maybe the Australian government

will step in if UTAS suffers liquidity problems? Moody’s reassured potential

Green Bond investors this would likely occur. Is the Australian government

aware of these implicit guarantees?

The State’s role and responsibilities

is something this Committee needs to resolve and make any necessary recommendations

if needed.

There are serious problems and/or

misunderstandings of government(s) and their relationships with UTAS that need

to be cleared up. Sooner rather than later would be the best option.

The 2022 financial statements have

brought into sharp relief the problems ahead.

(A summary of the data extracted from

UTAS’ Annual Reports used to prepare this note is attached at the end).

Net profits: Core and other

activities

Over the past eight years the pattern

of net profits is as follows:

The 2020 year saw unrealised

investment losses which severely impacted investment returns. The 2021 saw a

bounce back in markets with significant unrealised investment gains. The 2022

years saw more unrealised losses of $35.5 million which reduced net profits.

The financial overview in UTAS’ 2022

Annual Report makes it clear that the profit from core activities of teaching

and research “is the financial metric that management of the University

focuses most of its attention on.”[2] This metric always appears in Annual Reports but 2022 was the first

year, in a while at least, it received an explanation. A partial explanation is

probably a better description. Readers didn’t get a clear understanding of what

constitutes net profits.

A bit of history might assist. The

following graph show the contribution from core and other activities over the eight-year

period since 2015:

Over the past eight years core activities have contributed mostly losses. In 2022 the loss was $18.9 million[3], the biggest loss in the last 8 years. Only twice have core activities produced profits, in 2017 and 2020. Can we really believe that UTAS’ major financial focus is on profits from core activities? Or on other activities? Has past performance been satisfactory and if not, what has been done to rectify matters to meet the yet undisclosed profit targets for core activities. Is the Hobart CDB designed to address this problem? It has never been mentioned as a rationale for the move.

The overwhelmingly contributions to

UTAS’ net profits come from other sources. The following graph shows the

breakup of these amounts. Capital grants and investment income comprise the

bulk.

Just a few comments:

·

Capital

grants: Accounting conventions allow these to be included in net profit, but

arguably publicly funded grants to fund publicly owned entities to fund

buildings are more akin to equity contributions from public owners. The grants

are from both Federal and State government for specific building projects.

·

Net

investment income is self-explanatory. Interest paid has been netted off

against interest and dividends received, realised and unrealised gains from share

sales. Losses in any year are attributable to unrealised losses when adverse

market movements were experienced.

·

Statutory

funds are quasi equity amounts like trust funds and endowments for scholarship

purposes etc and other specific grants etc that cannot be used to fund general

expenditure.

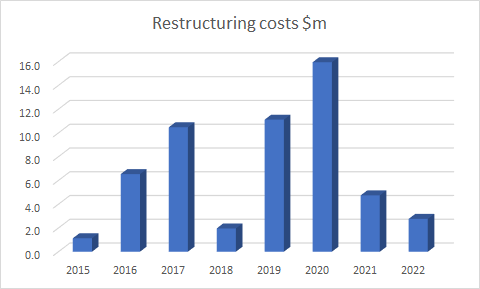

·

Other

are mainly restructuring costs. Restructuring costs are a such a constant

feature of UTAS’ business, a total of $54.7 million at an average of $6.8 pa

since 2015, it is hard to imagine why they’re not part of core activities. Are

they consultants’ costs? The costs of the Hobart transition? It is not clear

whether these have been capitalised or expensed when incurred?

Bar charts can be difficult to

comprehend at times. Sometimes a table will be better. The following table

lists the components of net profits in 2022 compared to the average over the

past eight years.

It’s a tell-tale story of UTAS’

operating model.

|

UTAS NET PROFITS $M |

||

|

2022 |

Average |

|

|

Net change stat funds |

4.9 |

8.2 |

|

Capital grants |

97.5 |

33.1 |

|

Net invest income |

37.6 |

26.8 |

|

Core activities |

18.9 |

4.0 |

|

Restructuring costs |

2.8 |

6.8 |

|

Other |

0.0 |

1.9 |

|

Total |

43.1 |

55.4 |

Neither statutory funds nor capital

grants fund general purpose operating expenses. Core activities produce losses

which must be funded from investment earnings. As do restructuring costs. That’s the major conclusion from looking at

profits over the past eight years.

It is quite staggering to see the

relentless pattern of restructuring costs. No explanations are given.

Are these to fund the Hobart CDB

move? If so, can we expect them for the next 10 years. If so, how will

restructuring costs, and core activities for that matter, be funded when

investment returns diminish? With subdued markets looking a distinct

possibility and perhaps more significantly as UTAS funds its Hobart CDB move,

investments will be redeemed, and investment returns will be much lower.

Will core activities and restructure

costs continue to be funded by borrowings? To be repaid when the proceeds from

the Sandy Bay development are received? An alternative doesn’t readily spring

to mind.

That’s UTAS’ financial plan. It’s not

what the spin doctors are saying but it’s what the financial statements reveal.

Is the government taking notice? UTAS

are selling off the family jewels just so they can keep funding core deficits

and keep paying restructure cost to consultants who keep telling them the

Hobart CDB move will be worth it.

We weren’t told the existing model

was broken. We were told the existing buildings were no longer fit for purpose

and nostalgia shouldn’t stand in the way of progress.[4]

Cash

flows

Perhaps more

significant than net profit is UTAS’ net operating cash. This underpins the

sustainability of any organisation. 2022 witnessed UTAS’ lowest net operating

cash result since 2015.

In 2022 the

net operating cash of $32.1 million was less than net profits of $43 million.

For most entities the reverse is true as non-cash items such as depreciation

usually means more cash than the net profit figure suggests. But UTAS has some characteristics

which means cash flow for capex works and repaying borrowings will be harder.

But first let’s

look at where net operating cash sits in the larger picture. The following is a

summary of the cash inflows and outflows over the last eight years:

|

UTAS CASH FLOW 2015 to 2022 $m |

|

|

Inflow |

|

|

Net operating cash |

461.7 |

|

Capital grants |

301.0 |

|

Borrowings net |

242.9 |

|

PBSA proceeds |

203.4 |

|

Outflow |

|

|

Purchases PPE net |

911.4 |

|

Purchase intangibles |

63.0 |

|

Investments net |

145.7 |

|

Other |

7.5 |

|

Net increase/(decrease) cash |

81.4 |

|

Opening cash |

48.2 |

|

Closing cash |

129.7 |

That’s UTAS

in a nutshell. By way of explanation:

·

Net

operating cash over 8 years totalled $461.7 million an average of $58 pa. As we

have seen the 2022 figure was $32.1 million.

·

Capital

grants from both the Federal and State governments totalled $301 m. These are

amounts intended for specific building projects.

·

Net

borrowings comprise net increases in borrowings over the period. Most occurred

in the 2022 year with the $350 m Green Bond capital raising and the repayment

of the Tascorp loan of $70 million.

·

The

PBSA (Purpose Built Student Accommodation) proceeds of $203.4 million comprise

the 2x amounts received in 2017 and 2021 when UTAS forward sold 30 years of

rents in respect of some student accommodation facilities (the Spark Living

deal). UTAS retains the underlying property, but Spark Living has bought the

rights to net rents for a 30-year period. The land and buildings which are part

of the deal are now described in UTAS’ books as a Service Concession asset. The

lump sum received is recorded as a liability, as a revenue in advance amount,

being the grant of the right to operate the PBSA over 30 years. Each year Spark

Living receives the net rents plus whatever other amounts are part of the deal,

and UTAS amortises/writes off a portion of the liability and includes the

amount as revenue in that year. In 30 years’ time the liability will disappear.

Each year however UTAS accounts will include the amortised portion as income.

But alas there won’t be an accompanying cash boost as Spark Living will pocket

the net rents. Paying off liabilities like the Spark Living deal means

operating cash will be less than net profits.

·

Purchases

of PPE (property plant and equipment) are the capex amounts, mainly land,

buildings and the ensuing upgrades.

·

Intangibles

mostly refers to software purchases, but also includes a 20-year license for

484 car parking spaces in Launceston which cost $5.5 million in 2022.

·

Net

investments of $145.7million were bought over 8 years. In 2022 $96 million of

investments were purchased using some of the proceeds from the $350 Green Bond

issue in 2022. 2022 wasn’t a great year to overdose on new investments as UTAS’

investment portfolio suffered unrealised losses of $35.5 million.

Balance

sheet

Now to turn

to UTAS’ statement of financial position, its balance sheet. The following sets

out the position in 2015 compared to eight years later in 2022.

|

UTAS BALANCE SHEET $M |

||

|

2015 |

2022 |

|

|

Assets |

||

|

Cash |

44.3 |

129.7 |

|

Receivables & contract assets |

31.3 |

73.7 |

|

Investments |

279.9 |

547.1 |

|

PPE/ PBSA |

745.6 |

1,423.8 |

|

Intangibles |

47.8 |

55.4 |

|

Other non-fin assets |

9.6 |

24.9 |

|

Total assets |

1,158.5 |

2,254.5 |

|

Liabilities |

||

|

Payables |

41.6 |

73.0 |

|

Borrowings |

118.6 |

360.0 |

|

Provisions |

79.3 |

104.3 |

|

Contract liabilities |

0.0 |

189.2 |

|

Other liabilities |

19.1 |

174.9 |

|

Total liabilities |

258.6 |

901.4 |

|

Net assets |

899.8 |

1,353.2 |

|

Equity |

||

|

Statutory Funds |

149.2 |

146.5 |

|

Reserves |

279.0 |

383.8 |

|

Retained earnings |

471.7 |

822.8 |

|

Total equity |

899.8 |

1,353.2 |

By way of

explanation:

·

Cash

is self-explanatory. The abnormally high balance in 2002 partly reflects the

proceeds of the 2022 Green Bond issue.

·

Receivables

and contract assets are amounts due for services rendered.

·

Investments

are shares and managed funds. The amount grew with the Spark Living receipts

(in 2017 and 2021) and with some of the Green Bond proceeds in 2022. At the end of 2022, approximately 60 per cent

or $317 million is listed as a current asset, with the remainder of $230

million listed as non-current. The current portion is likely to be redeemed

soon to help fund the Hobart CBD move, at least once most of the cash

disappears which will almost certainly happen in the 2023 year. The non-current

portion is safer (see below comment on statutory funds).

·

PPE/PBSA

are fixed assets of land buildings and plant, predominantly land and buildings.

The increase is due to the amounts spent (see above comments on the cash flow

statement) but also to the 2022 revaluation of $167 million, not included in

net profits, rather in the broader measure of comprehensive income. The only

other previous significant revaluation was a $58 million loss in 2017. The

growth in the value of PPE is quite modest given what has been spent on new

acquisitions and updates. Maybe commercial property may not have increased at the

rate achieved by residential property? Or maybe as has often been alleged, UTAS

overpaid for some of its acquisitions?

·

Intangibles

are software purchases(mainly).

·

Payables

are payments due. There was a $28 million jump in the 2022 year, almost

certainly due to PPE amounts payable.

·

Borrowings

in 2022 include the $350 million Green Bonds plus assorted leases. Bonds are

interest only borrowings. $280 million have a 10-year term. The remainder of

$70 million have a 20-year term.

·

Provisions

mainly relate to employee entitlements such as annual leave and long service

leave, but also includes a $14 million provision for wages due in respect of

wage theft which occurred from 2014 to 2021. A liability of $11 million was

included in the 2021 accounts at the last moment, listed as a current liability

meaning it was expected to be paid in the 2022 year. It is still unpaid and is

now listed as a $14 million liability.[5]

The 2022 Annual Report hinted at the reason for the delay. It became a ‘bespoke

internal audit project’[6]

which necessitated, you guessed it, more consultants.[7]

·

Contract

liabilities ($189.2 million in 2022) related to revenue in advance amounts

including research grants, capital grants and other unspent Australian

government assistance. When received these are recorded as revenue in advance.

Cash balances increase but there is no profit effect. When spent, cash is impacted,

but the profit effect is nil as a rule. The reduced liability is booked as

revenue at the same time as there is an offsetting expense. Managing contracted

liabilities is therefore a cash flow exercise.

·

Other

liabilities ($174.9 million in 2022) represent the yet to be amortised portion

of the $203.4 million received from Spark Living. The amortised portion each

year boosts profits but there’s no cash as the net rents are diverted to Spark

Living each year.

·

Re

contract and other liabilities, it needs to be understood how these impacts

profits and cash flows differently. Receiving revenue in advance amounts

including lump sum rentals in advance from Spark Living, is welcome when

received but painful when repaid/spent. What will tend to happen is that low

net profit amounts will be accompanied by even lower operating cash flows.

That’s the reality that UTAS must deal with.

·

Statutory

funds ($146.5 million in 2022) are quasi equity amounts included with equity,

being funds that cannot be used for general expenditure purposes. Included here

are trust funds and endowments used to fund scholarships etc. There will be

corresponding cash/investments on the asset side with restricted access.

·

Reserves

are principally the revaluation of land and buildings which are kept separate

from retained earnings in Equity. The 2022 year saw a $167 million increase in

the revaluation reserve.

·

Retained

earnings are self-explanatory, being the accumulated net profits earned and

retained by UTAS. UTAS doesn’t pay dividends.

It’s a

fairly tidy balance sheet, with just a few peculiarities which will impact UTAS

in the future.

However, to

get a clearer picture of UTAS over the past 8 years the following chart will

assist:

This shows

the increases in index form with the 2015 year equal to 100. In eight years,

liabilities have increased by 350 per cent yet net equity has grown by a mere

150 per cent. And that includes the $167 million revaluation of land and

building in 2022.

UTAS in

transition

If nothing

else UTAS’s financials indicate it is a vastly different operation than it was

8 years ago.

As I said in

my original submission to this inquiry:

“It

mustn’t be forgotten that the federal government is largely responsible for

setting the parameters that have pushed universities in the direction all have

taken.”

It’s an oft

repeated mantra by consultants and other profit whisperers that governments and

public bodies have ‘lazy’ balance sheets, and they should take a leaf out of

the private sector’s book. Arguably UTAS has been persuaded to swallow the

whole book.

The current State

government often asserts its financial management has left us with a strong

balance sheet which we shouldn’t be afraid to leverage. There’s a skerrick of

truth . We may have a strong balance sheet but as yet haven’t devised a way to

service extra borrowings.

In UTAS’s

case the same is true, but it has the additional burden of borrowings disguised

as other liabilities (the Spark Living deal) and other revenue in advance

amounts on its balance sheet.

It’s not too

difficult to pinpoint the private gains that will flow from UTAS’ moves, to the

papers shufflers and hangers-on. But what about the public gains. UTAS has said

it expects to make $200 million from the transition. Then again, the Green Bond

proceeds were expected to tide it over until surplus Sandy Bay assets started

selling. Which it clearly won’t.

What about UTAS’ core business? How will the crucial

financial metric of profit from the core activities of teaching and research be

impacted by the Hobart move, as distinct from remaining at the existing

campus?

With all the

recent public discussions about the role of universities, whether a profit-making

goal should be a performance indicator for the delivery of public goods like

higher educations is a moot point. But this is outside the Committee’s Terms of

Reference.

Returning to

UTAS’ current financial situation, there are other commitments that aren’t

included on its balance sheet relating to the Northern Transformation. Note 25

in UTAS’ 2022 Annual Report revealed there is $108 million of bills mostly for Launceston

redevelopment which will be paid in 2023 and another $22 million in subsequent

years.[8]

Together with the $14 million back wages and the capex bills included in

payables means most of the cash at the end of 2022 will disappear. It may have

happened already.

Next will be

a run down in investments as UTAS continues its mission to rearrange Hobart. Given

that UTAS needs to hold probably $200 million in cash or restricted assets

either because it’s a strict requirement (trust funds etc) or because prudent

management leaves no alternative (contracted liabilities etc) there may be $300

million or so of investments that can be redeemed soon to keep the dream alive.

In 2019 we

learnt it was going to cost $600 million for UTAS to build its new facilities

in the Hobart CDB.[9]

Early in 2023 The Mercury reported sizable cost blow outs on one of the

building refurbishments.[10]

It’s hard to imagine there won’t be more. Capital works have barely begun.

There are

scary times ahead. UTAS is a novice property developer, which makes delays more

likely. The governing Council doesn’t appear to be over endowed with the

necessary experience and skill sets to navigate its way in a sea infested with

charlatans and pwcers.

If UTAS proceeds

with its move to the Hobart CDB it will soon need more borrowed funds, probably

sometime in the next 12 to 24 months. That of course will require the

Treasurer’s approval pursuant to Sec 7(2) of the University of Tasmania Act

1992.

It is not

clear exactly why UTAS ditched Tascorp as a lender early in 2022 preferring

instead to raise $350 million via the Green Bond issue. But it is likely to have

been Tascorp’s more extensive due diligence procedures, possibly, shock horror,

even having a detailed look at UTAS plans to move into Hobart City and the

residential development of the Sandy Bay campus. UTAS would have needed to

surrender some security as well as providing a few more details about some of

the financial assumptions underpinning the dream.

Different

from conventional lenders like Tascorp, Green Bond holders don’t hold specific

security. They are comforted by representations made to them by UTAS and its

agents and by Moody’s. The Green Bond issue effectively has given UTAS a carte

blanche opportunity to do as it pleases.

At least until

it runs out of money and needs to front the Treasurer with an Oliver Twist

impersonation. Please Sir, I want some more.

This is

likely to happen in the not-too-distant future. That is why this Committee need

to carefully consider its views on Sec 7(2). What is the underlying intention?

Has it worked as intended? If not, what changes need to be made?

There are

also diverging views on the extent of implicit guarantees for UTAS’ borrowings.

Prof Black told the Committee on 4th May 2023:[11]

“Because

it is an institution of the state - and in the end, this will come to the kind

of view of ratings agencies - there has always been an implicit assumption that

should the university ultimately be in financial trouble, that would come to be

a liability of the state's credit under the state act. In a university of our

scale that could be a material matter for the state, so it is the kind of thing

that ratings agencies give consideration to when they are evaluating states as

to what their potential exposure to liabilities would be. The technical ways in

which that is done are complex, but that is why it does matter, because in the

end we are an entity of the state.”

It’s hard to

accept Prof Black believes UTAS is simply an entity of the State. Maybe he is

sending a signal to the government that he’ll be needing some bailout funds

soon. Is he laying the groundwork before approaching the government with his

demands? Moral hazard and the too-big-to-fail

mentality mean governments everywhere get bullied.

If UTAS is

an entity of the state, the UTAS Act needs to change to reflect this, and the

Treasurer needs to confirm it in the Treasurer’s Annual Financial Report each

year. Arguably it also needs to be disclosed in UTAS’s Annual Report.

Maybe

Moody’s too believes the State government will always back UTAS. That’s why it gave

it the same credit rating.

Or maybe that’s because Moody’s

believes the Commonwealth government will come to the party when needed, as it

would if a State got into real trouble. Moody’s told potential subscribers to

the Green Bond issue that there is “a high likelihood of extraordinary

support from the Commonwealth in the event of acute liquidity

stress.”[12]

These are not esoteric matters that

can be let through to the ‘keeper. They need to be sorted sooner rather than

later.

Ordinarily if an entity starts

incurring cost blowouts for a crucial project and needs to borrow more, bond

holders who rank behind secured creditors will sit up and take notice. The

credit rating of the entity may change[13].

A fall in bond prices (on the secondary market) is a real possibility. Bond

holders will suffer capital losses if they dispose of their holdings.

If all this transpires when the

underlying government guarantees are better and more widely understood, bond

holders might well have an argument of being misled into believing UTAS was an

institution that will always be backed by governments. Is this the case?

Distressed bondholders selling to

vulture funds all too willing to take on bond issuers are an ugly reality of today’s

over-financialised world. The last thing a government would wish for is a

public battle of this nature. That’s why if it ever happened it is sure to be

settled out of the limelight at great cost to Tasmanians.

Appendix:

8 years data (from UTAS Annual Reports)

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

UTAS CASH FLOW SUMMARY 2015 to 2022 $m |

||||||||

|

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

|

|

Inflow |

||||||||

|

Net operating cash |

41.1 |

55.9 |

48.6 |

76.9 |

40.8 |

84.5 |

81.8 |

32.1 |

|

Capital grants |

5.8 |

17.5 |

27.1 |

23.0 |

17.8 |

64.6 |

105.0 |

40.3 |

|

Borrowings net |

23.0 |

15.5 |

9.5 |

0.0 |

97.6 |

71.6 |

58.1 |

277.1 |

|

PBSA proceeds |

0.0 |

0.0 |

132.6 |

0.0 |

0.0 |

0.0 |

70.8 |

0.0 |

|

Outflow |

||||||||

|

Purchases PPE net |

92.9 |

73.4 |

51.6 |

97.1 |

188.2 |

75.2 |

215.3 |

117.6 |

|

Purchase intangibles |

5.4 |

6.8 |

8.7 |

6.9 |

9.7 |

2.6 |

3.2 |

19.7 |

|

Investments net |

25.3 |

4.5 |

112.9 |

0.8 |

26.1 |

34.1 |

18.9 |

95.6 |

|

Other |

0.8 |

0.0 |

1.0 |

1.6 |

2.5 |

0.3 |

1.2 |

0.1 |

|

Net increase/(decrease)

cash |

4.0 |

26.8 |

24.6 |

4.9 |

18.2 |

33.4 |

39.2 |

116.5 |

|

Opening

cash |

48.2 |

44.3 |

17.4 |

42.0 |

37.1 |

18.9 |

52.3 |

13.1 |

|

Closing

cash |

44.3 |

17.4 |

42.0 |

37.1 |

18.9 |

52.3 |

13.1 |

129.7 |

|

UTAS

BALANCE SHEET SUMMARY 2015 to 2022 $m |

||||||||

|

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

|

|

Assets |

||||||||

|

Cash |

44.3 |

17.4 |

42.0 |

37.1 |

18.9 |

52.3 |

13.1 |

129.7 |

|

Receivables & contract assets |

31.3 |

33.2 |

32.6 |

35.3 |

40.6 |

45.1 |

68.2 |

73.7 |

|

Investments |

279.9 |

288.4 |

419.6 |

404.3 |

442.6 |

400.2 |

494.3 |

547.1 |

|

PPE/ PBSA |

745.6 |

783.9 |

747.2 |

808.6 |

969.3 |

1,002.6 |

1,170.1 |

1,423.8 |

|

Intangibles |

47.8 |

49.6 |

51.0 |

51.2 |

52.7 |

47.4 |

42.7 |

55.4 |

|

Other non fin assets |

9.6 |

9.5 |

10.4 |

11.0 |

15.4 |

14.5 |

26.6 |

24.9 |

|

Total

assets |

1,158.5 |

1,182.0 |

1,302.9 |

1,347.4 |

1,539.5 |

1,562.2 |

1,815.0 |

2,254.5 |

|

Liabilities |

||||||||

|

Payables |

41.6 |

53.9 |

34.4 |

30.6 |

37.6 |

48.9 |

44.6 |

73.0 |

|

Borrowings |

118.6 |

103.1 |

93.6 |

93.6 |

209.6 |

135.3 |

82.9 |

360.0 |

|

Provisions |

79.3 |

87.8 |

89.9 |

87.4 |

94.2 |

94.1 |

101.1 |

104.3 |

|

Contract liabilities |

0.0 |

0.0 |

0.0 |

24.4 |

115.5 |

188.1 |

257.8 |

189.2 |

|

Other liabs |

19.1 |

25.6 |

172.7 |

140.0 |

124.5 |

119.5 |

186.1 |

174.9 |

|

Total

liabilities |

258.6 |

270.4 |

390.6 |

376.0 |

581.4 |

585.8 |

672.6 |

901.4 |

|

Net assets |

899.8 |

911.6 |

912.3 |

971.4 |

958.1 |

976.3 |

1,142.4 |

1,353.2 |

|

Equity |

||||||||

|

Statutory Funds |

149.2 |

162.3 |

173.5 |

196.9 |

120.1 |

123.1 |

146.1 |

146.5 |

|

Reserves |

279.0 |

275.2 |

217.1 |

217.1 |

217.3 |

217.0 |

217.0 |

383.8 |

|

Retained earnings |

471.7 |

474.0 |

521.7 |

557.4 |

620.7 |

636.2 |

779.3 |

822.8 |

|

Total

equity |

899.8 |

911.6 |

912.3 |

971.4 |

958.1 |

976.3 |

1,142.4 |

1,353.2 |

[1]

This is what Moody’s told Green Bond investors when granting UTAS a credit

rating in Dec 2021.See UTAS' Green Bond rating raises major issues - The UTAS

Papers

[2]

UTAS Annual Report 2022 page 34

[3]

Ibid page 24

[4] See former Chancellor Michael Field’s opinion

piece in The Mercury accessed here https://www.saveutascampus.com/_files/ugd/54d3ee_48c62753505b4493a2520db051a03c5a.pdf

[5]

Ibid page 75

[6]

Ibid page 26

[7]

Ibid page 75

[8]

Ibid page 83.

[13]

Moody’s have flagged this possibility . See UTAS' Green Bond rating raises major issues - The UTAS

Papers

[14]

The Profit and Loss statement (the Income Statement) each year includes a note

reconciling net profits with profits from core activities. The note has been

re-formatted to show the break-up of Net profits into the various components.

[15]

This is from the Note each year which is included in the financial statement as

Notes to the Statement of cash Flows (Note 29 in the 2022 Annual Report)

No comments:

Post a Comment